Team of financial experts providing full-service Finance & Accounting Outsourcing (FAO) services to clients globally.

- No compromise on quality service

We are financial experts – No Compromise!

Whether it is great technical advice, the timely delivery of an important project or simply the assurance that comes from a trusted advisor relationship, in the end it is our people who make the difference. In this F&A Outsourcing Profile, we present an overview of the services we provide our clients globally and a sense of the talent that you can call on at GT BPO LLC.

Our Vision!

Our vision is to be the clear choice by ensuring our people are extraordinary, our clients see a difference in us and trust us.

We aim to become the clear choice by:

- Focusing on quality and excellent service

- Taking a long-term, sustainable view

- Acting as a multi-disciplinary firm

- Being passionate about our clients and our work

- Deploying globally highly talented people

- Bringing insights and innovative ideas

We take great pride in the professional services that we provide our clients and the quality of our people.

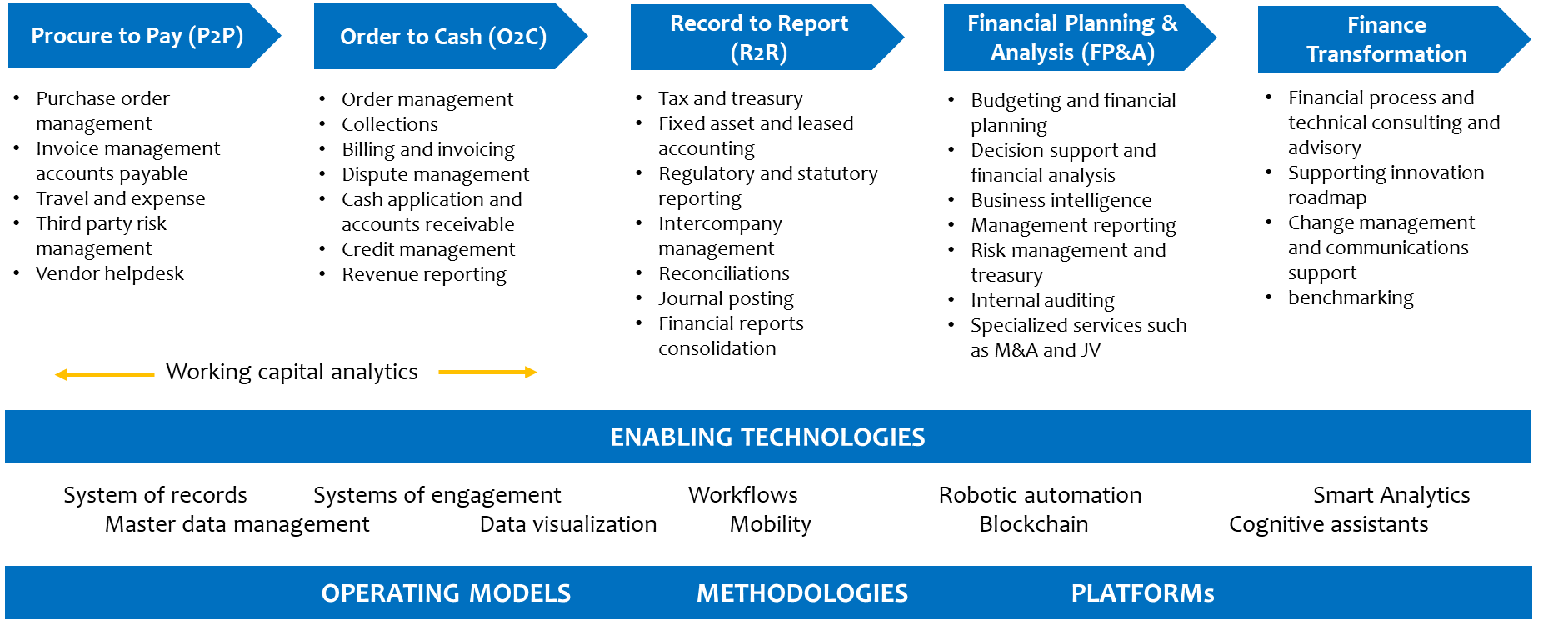

FAO Services Offering

We have experienced that the nature of finance and accounting outsourcing (FAO) engagements has evolved from transactional to becoming more holistic, to align with changing business and technology needs. Enterprises are increasingly willing to transform their finance and accounting operations and embrace digital technologies to make processes more efficient, increase productivity, improve data accuracy, reduce costs and enhance customer experience.

Automation and analytics have been integral parts of every contract that we signed for FAO services in the last two years, thereby empowering CFOs with real-time insights and meaningful information to enable quick decision-making and, subsequently, help finance departments function more efficiently.

We work closely with our clients based on our solutions and skillsets to provide the best mix of strategic consulting, digital transformation and process outsourcing services. We have built and strengthened our partner ecosystem to marshal the broad and deep expertise required to produce strategic breakthroughs.

We address the urgent new challenges for our FAO services clients, including, but not limited to:

Hybrid operating models: We manage office and remote staff with the assurance that security, fraud prevention and compliance requirements are strictly met.

- Talent: We have prioritized the best models for hiring, developing, motivating and retaining key skillsets.

- Increasing convergence of BPO and IT/digital service lines: We have combined different solutions and skillsets to provide holistic offerings to our clients.

Our FAO Services Value Chain

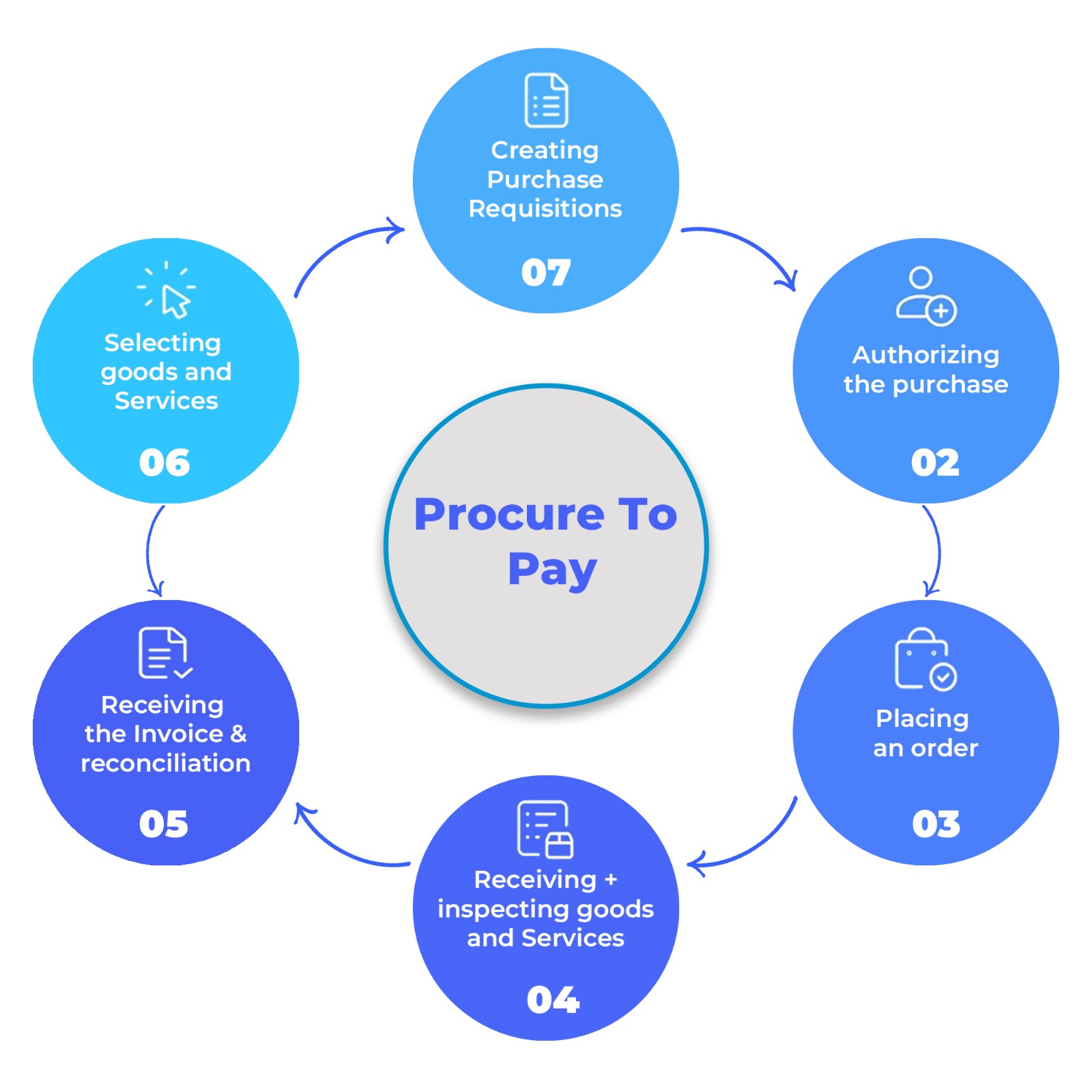

Procure to Pay (P2P) Services

Our P2P services offering cover complete range of payable processes, from capturing, processing invoices, vendor queries, master data management and claims management to ensuring on-time payment, while minimizing value leakages and enhancing vendor and employee satisfaction.

The nature of these transactions not only requires an understanding of the domain, but also relies on effective leveraging automation and analytics. The automation journey is not limited to robotic process automation (RPA) but goes a step further to enable decision-making and managing an enterprise’s finances more efficiently. We offer AI with natural language processing (NLP) capabilities and machine learning. We also provide optical character recognition (OCR) technology to facilitate electronic processing of both paper and digital invoices.

Our strengths:

- We have a strong vision our FAO practice with industry standard P2P services offering

- We bring in deep domain and technology expertise, including automation, analytics, AI, machine learning, cloud and blockchain.

- We have a strong partner ecosystem across F&A service lines to drive innovation and digital transformation.

- We demonstrate ability to provide vertical-specific platform solutions and offer guidance on process optimization to deliver tangible benefits.

- We employ design thinking or alternative methodologies to involve client in designing products and services or the transformation roadmap.

- We demonstrate industry and domain expertise to deal with core finance functions and leading digital implementation of roadmap design

- We have referenceable case studies

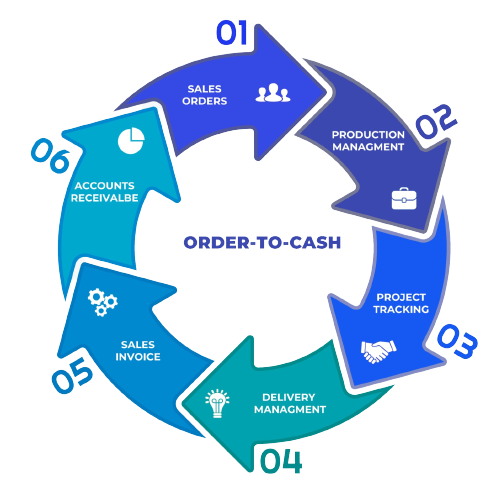

Order to Cash (O2C) Services

Most of our first-generation and new clients began their FAO journey with us by outsourcing less complex finance functions, including O2C, that are repetitive and transactional in nature.

We provide end-to-end O2C services, supporting the complete customer-to-cash lifecycle, driving more efficient processes, improving working capital performance and reducing days sales outstanding (DSO). This provides with our clients with more flexibility to price products and services competitively and gain a market advantage.

We not only bring domain expertise, but also fulfill clients expectations for the active use of automation and analytics.

Our strengths:

- We have a strong vision our FAO practice with industry standard O2C services offering

- We bring in deep domain and technology expertise, including automation, analytics, AI, machine learning, cloud and blockchain.

- We have a strong partner ecosystem across F&A service lines to drive innovation and digital transformation.

- We demonstrate ability to provide vertical-specific platform solutions and offer guidance on process optimization to deliver tangible benefits.

- We employ design thinking or alternative methodologies to involve client in designing products and services or the transformation roadmap.

- We demonstrate industry and domain expertise to deal with core finance functions and leading digital implementation of roadmap design

- We have referenceable case studies

Record to Report (R2R) Services

We have experienced that our digital-native and second-generation clients more readily outsource high-end and complex finance functions to us, such as R2R, and they seek insights from us that are actionable and in real-time.

We provide end-to-end R2R services, such as general ledger accounting and reconciliation, inter-company accounting, fixed assets accounting, regulatory compliance and taxation, and treasury and risk management, using right mix of automation, intelligent data and workflow solutions, and advanced business analytics.

These are aimed at empowering CFOs to focus on their core business, get real-time insights to make decisions quickly, and enable their finance departments to function more effectively with greater accuracy.

We not only bring domain expertise, but also fulfill clients expectations for the active use of automation and analytics.

Our strengths:

- We have a strong vision our FAO practice with industry standard R2R services offering

- We bring in deep domain and technology expertise, including automation, analytics, AI, machine learning, cloud and blockchain.

- We have a strong partner ecosystem across F&A service lines to drive innovation and digital transformation.

- We demonstrate ability to provide vertical-specific platform solutions and offer guidance on process optimization to deliver tangible benefits.

- We employ design thinking or alternative methodologies to involve client in designing products and services or the transformation roadmap.

- We demonstrate industry and domain expertise to deal with core finance functions and leading digital implementation of roadmap design

- We have referenceable case studies

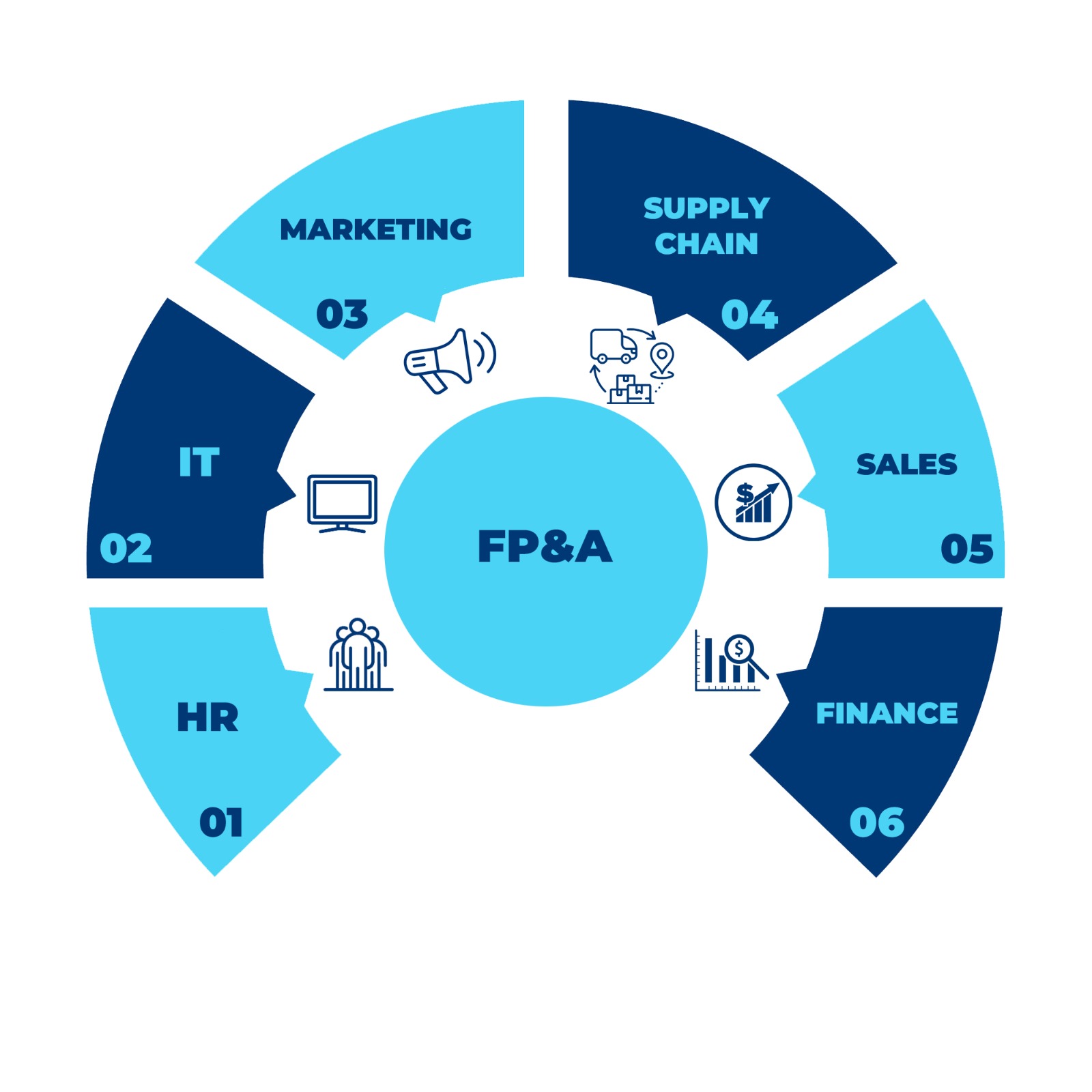

Financial Planning and Analysis (FP&A) Services

We have experienced that high-end and complex F&A functions such as FP&A that were once retained by companies are now being outsourced, enabling Tier-1 FAO services providers like us to deliver comprehensive and meaningful data and insights to our clients.

We view our clients as strategic partners to offer real-time insights and support faster decision-making. The services include budgeting, forecasting, financial planning, decision support and financial analysis, management reporting and undertake M&A and divestiture analysis. We provide CFOs with timely, reliable financial insights and reports for effective decision-making.

These are aimed at empowering CFOs to focus on their core business, get real-time insights to make decisions quickly, and enable their finance departments to function more effectively with greater accuracy.

We not only bring domain expertise, but also fulfill clients expectations for the active use of automation and analytics.

Our strengths:

- We have a strong vision our FAO practice with industry standard FP&A services offering

- We bring in deep domain and technology expertise, including automation, analytics, AI, machine learning, cloud and blockchain.

- We have a strong partner ecosystem across F&A service lines to drive innovation and digital transformation.

- We demonstrate ability to provide vertical-specific platform solutions and offer guidance on process optimization to deliver tangible benefits.

- We employ design thinking or alternative methodologies to involve client in designing products and services or the transformation roadmap.

- We demonstrate industry and domain expertise to deal with core finance functions and leading digital implementation of roadmap design

- We have referenceable case studies

Our Clients Archetypes Analysis

Based on our FAO market analysis and personal experience of working with clients of all business sizes and geographies, we have categorized these into four archetypes for the finance and accounting outsourcing (FAO) services

Transactional Services Buyers

These are generally our new clients, seeking to outsource less complex functions that are repetitive and transactional in nature. The most frequently outsourced functions mainly include O2C, P2P and some components of R2R transactions. Their main focus is on reducing the cost of processing transactions by using our offshore labor arbitrage. However, we have seen that RPA adoption is increasing among these clients, and basic automation has become table stakes with these engagements.

Transformation-oriented Clients

Our clients in this archetype seek to transform their F&A operations to be ahead of the curve, improve customer experience and optimize the use of technology to their advantage. Embracing the chain of digital technologies is of prime importance to these clients. Their outsourcing objective is not limited to transactional processes. Analytics is one of the key focus areas, as CFOs increasingly focus on their core business and use technology to get real-time insights, make quick decisions and enable their finance departments to function kore effectively. Also, our clients in this archetype believe that effective training and talent upskilling are key to a success transformation.

Automation Implementers

Our clients in this archetype seek to leverage automation extensively, and their outsourcing objective is not limited to cost savings. These clients are more mature and consider outsourcing these functions that go beyond transactional, and include critical functions such as budgeting, forecasting, financial planning, decision support and financial analysis, management reporting, M&A and divestiture analysis etc. The objective is to leverage the benefits of technology to get deep insights for decision-making. Automation in this category is not limited to rule-based automation, but blends intelligence into processes.

Holistic Partner Clients

Our clients in this archetype seek to seek to outsource end-to-end F&A functions so they can focus on their core business activity. The objective of these clients goes beyond technology, which continues to be a priority. These clients seek a strategic partnership with us as we understand their business and related processes, and we offer solutions that can help them achieve their business objectives. We leverage technology to accelerate the time-to-market as a critical initiate in this type of engagement with our clients.

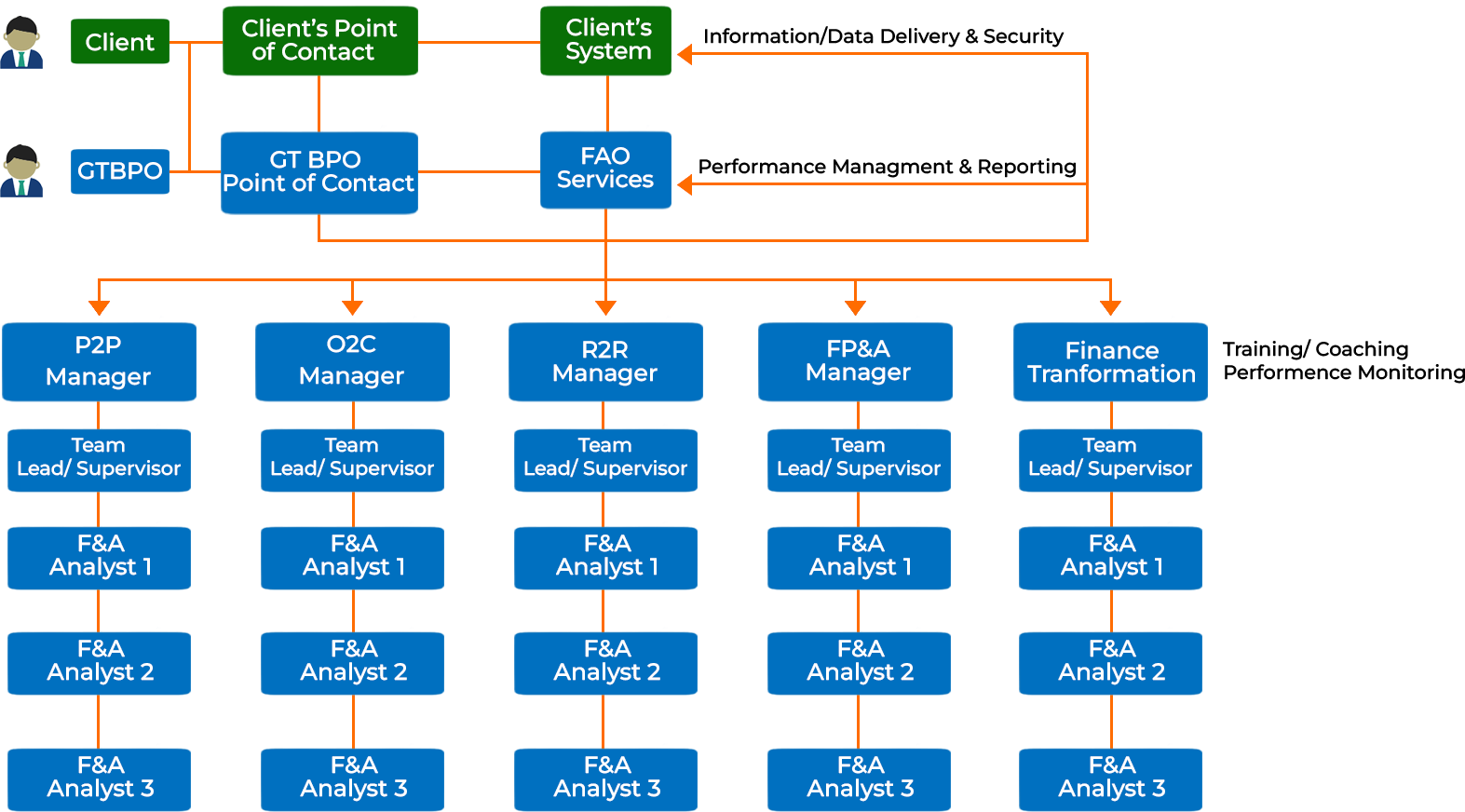

Our FAO Services Service Model

Our FAO Services Experience & Insights

As we have been providing FAO services to clients in diverse industries and geographies, we maintain knowledgebase of our experiences and insights for the mutual benefit of our clients and internal teams.

Some of the key insights are as follows:

Traditionally, FAO has been limited to transaction-intensive processes with labor arbitrage being the key driver behind outsourcing.

However, more judgement-intensive processes with end-to-end process driven approach has evolved with development in technologies, and provider’s capabilities.

Successful F&A transformation impacts the whole service experience for end customers and internal employees.

Large majority of CFOs rank top-line growth as the #1 business objective for finance.

The role of smart CFO is evolving from being the bottom-line and compliance enforcer to a trusted business partner driving profitable growth.

Emerging technologies help organizations break down their front, middle and back-office silos to mature into one integrated system to enable employees, delight customers, and deliver on its purpose.

Operational finance must become invisible to allow finance professionals to focus on strategic finance objectives.

Understanding of client, our cultural fit, and delivery capabilities are the primary outsourcing criteria of F&A industry.

start your free consultation

Teaming up with a trusted partner guarantees your business operations addresses all of your ethical outsourcing concerns.

- Tabish Hafeez